Commercial truck depreciation calculator

Calculate depreciation maximum limit for light truck and mini van as business expenses corp for year 2017 New Mini van total cost. We expect to incur these.

Straight Line Depreciation Formula Guide To Calculate Depreciation

Three-fourth-ton trucks add more power via better engines and.

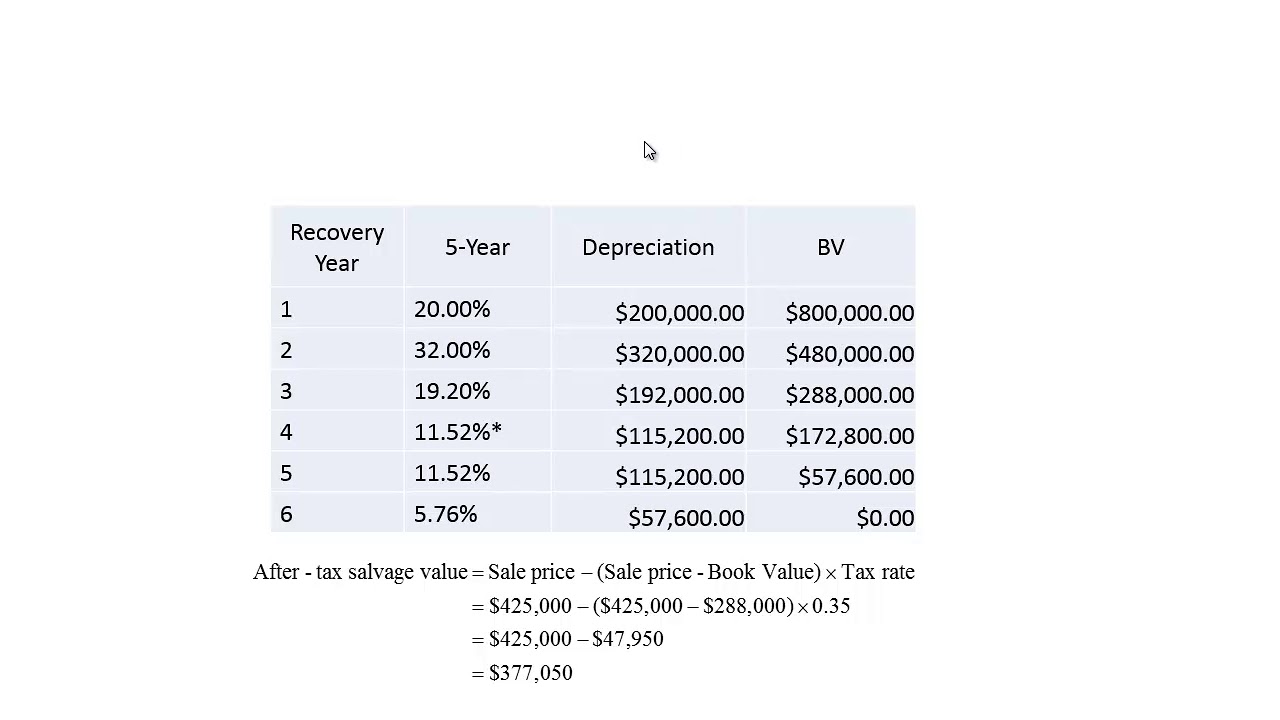

. 5 year Class life is the number of years over which an asset can be depreciated. Commercial sales comprised 443 of our total. The recovery period of property is the number of years over which you recover its cost or other basis.

Indeed the Section 179 tax deduction puts more money in the pockets of growing. It is determined based on the depreciation system GDS or ADS used. The calculator is a great way to view.

The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and. 23 September 2013 As per the Income tax act depreciation rate for the vehicles used for business purpose transport operation is 30. Annual Depreciation Expense 50000 -.

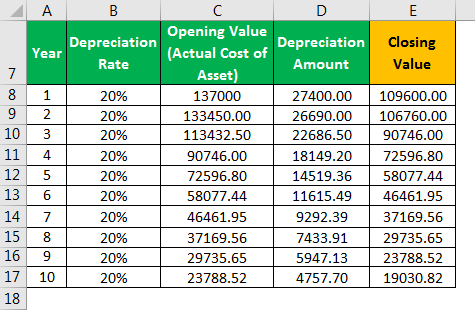

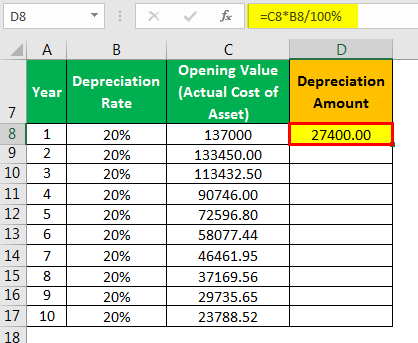

Depreciation of most cars based on ATO estimates of useful life is. D i C R i. All you need to do is.

How to Calculate Depreciation on a Rental Property. Depreciation limits on business vehicles. BGC Partners NASDAQBGCP is a combined interdealer.

The calculator also estimates the first year and the total vehicle depreciation. Real estate depreciation is a complex subject. If such asset is purchased on.

How many years can I depreciate a truck. Is approximately 50 million to 60 million for the equipment building and infrastructure. It is fairly simple to use.

The MACRS Depreciation Calculator uses the following basic formula. However different cars depreciate at different rates with SUVs and trucks generally. This car depreciation calculator is a handy tool that will help you estimate the value of your car once its been used.

Even better this bonus depreciation is retroactive back to September 27 2017 and works up until 2022. 35467 purchase Aug 2015 usepurpose. The tax law has defined a specific class life for each type of asset.

You probably know that the value of a vehicle drops. Where Di is the depreciation in year i. Select the currency from the drop-down list optional Enter the.

Up to 24 cash back We want to calculate how much the truck will depreciate each year for this we use the straight-line method formula above. Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. According to a 2019 study the average new car depreciates by nearly half of its value after five years.

Let the Depre123 depreciation calculator take out the guess work. Just enter 3 simple values Cost Date Class and get all the answers. Half-tons are the ideal and most popular trucks for family use and include the Ford F-150 and Chevy Silverado.

C is the original purchase price or basis of an asset.

Depreciation Formula Calculate Depreciation Expense

Depreciation Macrs Youtube

Heavy General Purpose Truck Depreciation Calculation Depreciation Guru

Car Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Light General Purpose Truck Depreciation Calculation Depreciation Guru

Depreciation Formula Calculate Depreciation Expense

Simple General Ledger In Excel Format Have Following Parts Accounting Journal Excel Template Accounting Jour General Ledger Excel Spreadsheets Templates Excel

How To Calculate Depreciation Expense For Business

Pin On Car Insurance

Depreciation Formula Calculate Depreciation Expense

Double Declining Balance Depreciation Calculator

How To Calculate Depreciation Youtube

Heavy General Purpose Truck Depreciation Calculation Depreciation Guru

Depreciation Schedule Template For Straight Line And Declining Balance

Macrs Depreciation Calculator Irs Publication 946

Photography Service Business Plan Laundry Business Laundromat Business Laundry Service Business